Agroclimatica risk score: Assessing agricultural financing and insurance risks with precision.

Notice: Undefined index: options in /home/xs999583/sustainaseed.net/public_html/db.sustainaseed.net/wp-content/themes/dlist/inc/directorist-support.php on line 318

Notice: Trying to access array offset on value of type null in /home/xs999583/sustainaseed.net/public_html/db.sustainaseed.net/wp-content/themes/dlist/inc/directorist-support.php on line 318

Notice: Trying to access array offset on value of type null in /home/xs999583/sustainaseed.net/public_html/db.sustainaseed.net/wp-content/themes/dlist/inc/directorist-support.php on line 318

What we do

Agroclimatica is a bioclimatic data platform that provides Risk Scores based on scientific data from:

Company's story

Our Specialty

Product Portfolio:

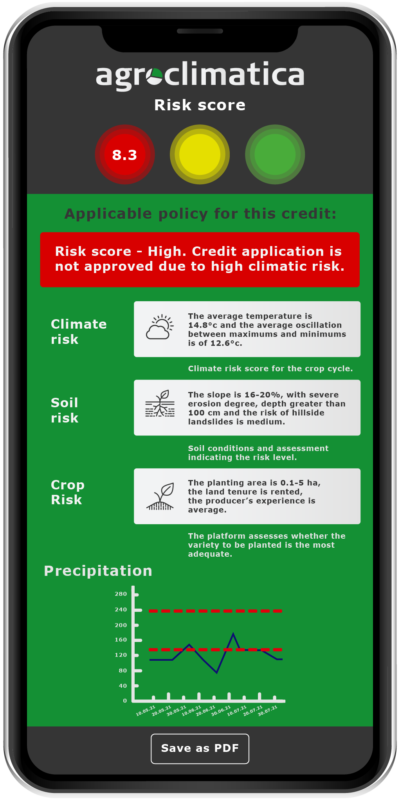

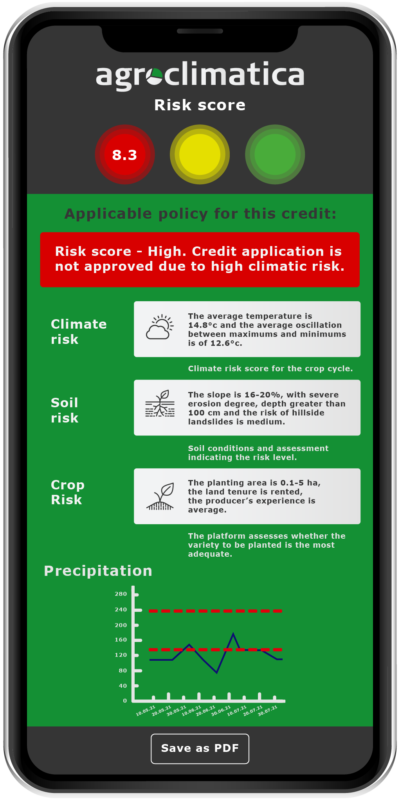

Risk Score

Quantification of production-related risk for a specific farm, productive activity, type producer, and period of time

Value Added Products

Climate Smart Crop Identifier, Harvest Predictor, CO2 Quantifier, Management module for portfolio optimization, Agricultural insurance risk assessment, Social performance management indicators, Design climate-smart financial products, B2C opportunities,

Agricultural investment feasibility study, Efficient & impactful technical assistance program

Risk Score

Quantification of production-related risk for a specific farm, productive activity, type producer, and period of time

Value Added Products

Climate Smart Crop Identifier, Harvest Predictor, CO2 Quantifier, Management module for portfolio optimization, Agricultural insurance risk assessment, Social performance management indicators, Design climate-smart financial products, B2C opportunities,

Agricultural investment feasibility study, Efficient & impactful technical assistance program

Our story

Agroclimatica is established as a bioclimatic data platform that provides risk scores based on scientific data of climate, soil, crop, livestock, and their respective good agricultural practices. We identify and quantify the risks and opportunities related to agricultural financing and insurance.

Since launching in Central and South America as well as Kenya and preparing for India, the reception and assimilation of Agroclimatica has been very positive and many financial institutions are now working on including the agroclimatic risk scoring along with the traditional financial risk score as part of their standard internal processes when assessing agricultural credit applications.

Our mission is to promote long-term sustainable financial inclusion and climate-smart agriculture globally.

Our vision is to support efforts towards food security and the eradication of poverty by promoting economic growth through climate-smart solutions that foment financial inclusion.

Since launching in Central and South America as well as Kenya and preparing for India, the reception and assimilation of Agroclimatica has been very positive and many financial institutions are now working on including the agroclimatic risk scoring along with the traditional financial risk score as part of their standard internal processes when assessing agricultural credit applications.

Our mission is to promote long-term sustainable financial inclusion and climate-smart agriculture globally.

Our vision is to support efforts towards food security and the eradication of poverty by promoting economic growth through climate-smart solutions that foment financial inclusion.

General Information

Gallery